Unpacking the Misconception: Does Afterpay Affect Credit Score and Your Financial Future?

Unpacking the Misconception: Does Afterpay Affect Credit Score and Your Financial Future?

Blog Article

Comprehending Just How Making Use Of Afterpay Can Effect Your Credit Report Score

As consumers progressively turn to hassle-free payment methods like Afterpay for their purchases, it is vital to consider the potential effect on their credit history rating. The method Afterpay utilization is reported to credit scores bureaus and the aspects that influence just how it can impact your credit scores score might not be quickly evident.

How Afterpay Usage Is Reported

When considering how Afterpay usage is reported, comprehending the effect on credit report is important. Afterpay, a popular buy currently, pay later solution, has actually acquired substantial grip amongst customers. However, its reporting methods can have implications for debt ratings. Commonly, Afterpay does not carry out a credit report check when customers register for the solution. Because of this, the application of Afterpay does not straight impact credit history.

Nevertheless, Afterpay might report missed out on defaults or repayments to credit history coverage companies if users fail to meet their repayment commitments. does afterpay affect credit score. These adverse marks can have a damaging influence on credit report and may make it harder for people to access credit score in the future. It is important for Afterpay individuals to be mindful of their payment target dates and guarantee that they accomplish their obligations immediately to avoid any type of adverse effects on their credit score accounts

Variables Influencing Credit History Effect

Another substantial factor is credit history usage, which refers to the amount of credit scores being used contrasted to the complete offered credit history. Using Afterpay for a huge percentage of available credit scores might suggest financial strain and possibly lower credit score scores. In addition, the length of credit score background plays a duty; enduring Afterpay accounts with a positive repayment background can have an extra favorable effect on credit score scores contrasted to newer accounts.

Taking Care Of Afterpay Responsibly

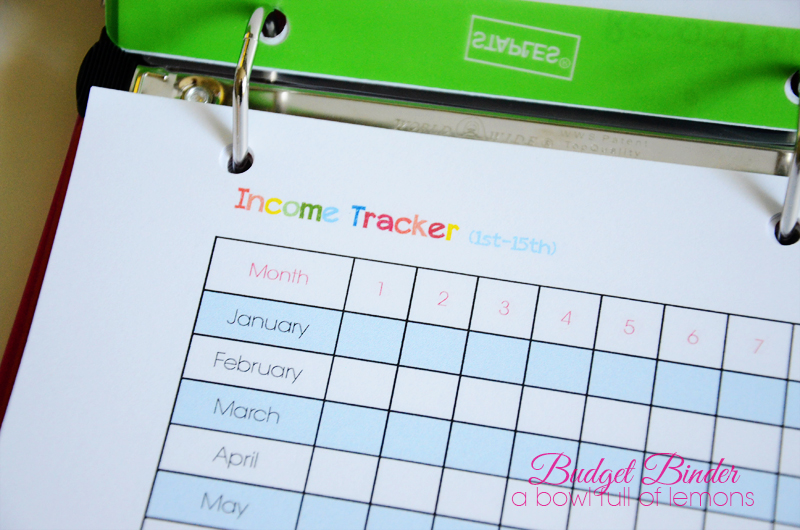

Effectively handling your Afterpay use is essential for keeping a healthy and balanced credit profile and economic stability. To guarantee liable Afterpay management, it is critical to stay organized and keep an eye on your settlement routines. Set tips or automate repayments to prevent missing due dates, as late payments can negatively impact your credit report. Additionally, just utilize Afterpay for purchases that you can manage to settle on schedule to avoid building up debt.

Checking your total costs habits is also type in handling Afterpay properly. Keep an eye on your total amount exceptional Afterpay equilibriums and ensure they line up with your spending plan. Frequently reviewing your Afterpay transactions can assist you see post recognize any type of unneeded expenditures and make modifications as needed.

Surveillance Credit History Modifications

Numerous tools and services are available to help you monitor your credit report comfortably. Many financial establishments and charge card business supply complimentary credit rating tracking as component of their services. Additionally, there are various on-line platforms where you can access your debt score totally free or for a small fee. By making use of these resources, you can stay aggressive in handling your credit history wellness and make notified choices regarding your monetary well-being. Bear in mind, a healthy credit history is essential for protecting favorable loan terms, renting out an apartment, or perhaps landing specific work.

Long-Term Effects on Creditworthiness

Consistently examining your credit report rating not only aids you stay notified about any see it here changes but also plays an essential duty in understanding the long-term results on your creditworthiness when utilizing services like Afterpay. While Afterpay itself does not report your settlement background to credit report bureaus, missed repayments or skipping on Afterpay installation plans can indirectly influence your credit rating. These unfavorable marks on your credit record can lower your debt rating and remain on your record for several years, influencing your creditworthiness when using for lendings, home mortgages, or credit scores cards in the future.

Conclusion

In conclusion, understanding just how using Afterpay can impact your credit scores score is essential for maintaining monetary health and wellness. By knowing how Afterpay application is reported and the variables influencing credit history impact, individuals can take care of Afterpay sensibly to decrease unfavorable impacts on their credit reliability. Checking credit report transforms frequently and knowing the long-lasting impacts of this Afterpay use can help people make notified financial choices and keep a favorable credit report profile.

One more substantial aspect is credit rating utilization, which refers to the amount of credit history being utilized compared to the overall readily available credit score (does afterpay affect credit score). Using Afterpay for a large percent of readily available credit score may suggest monetary strain and potentially lower credit ratings. In addition, the size of credit report background plays a role; long-lasting Afterpay accounts with a favorable settlement background can have a much more positive impact on debt ratings contrasted to more recent accounts. While Afterpay itself does not report your payment history to credit report bureaus, missed payments or failing on Afterpay installment strategies can indirectly affect your debt score. These adverse marks on your credit record can decrease your debt score and stay on your document for several years, influencing your credit reliability when using for fundings, home mortgages, or debt cards in the future

Report this page